Blog - Details

Addressing the Elephant: Downgrading India to 3.0 Stars

Indian firms are estimated to grow at a fast pace in coming years. After examining their valuations, we are downgrading the India market to 3.0 Stars from 3.5 Stars due to their high valuations and opportunity costs.

Step aside China, the fastest-growing largest economy in the world belongs to India now. With the feel-good story surrounding India, we examine if the equities market is deserving of its current valuations.

Valuations are over the top

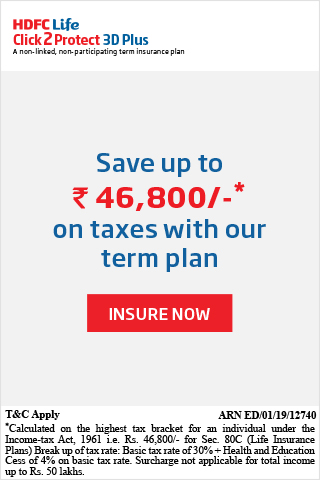

Looking at the forward PE ratio of the SENSEX Index, it seems to be on an up trend which is worrying as investors are already pricing in high growth.

For FY2019 (ending Mar 19), the forward PE ratio is at 21.5. With an expected earnings growth of 23.7%, FY2020’s forward PE ratio is at 17.4X, which will bring the SENSEX index to slightly below its fair value.

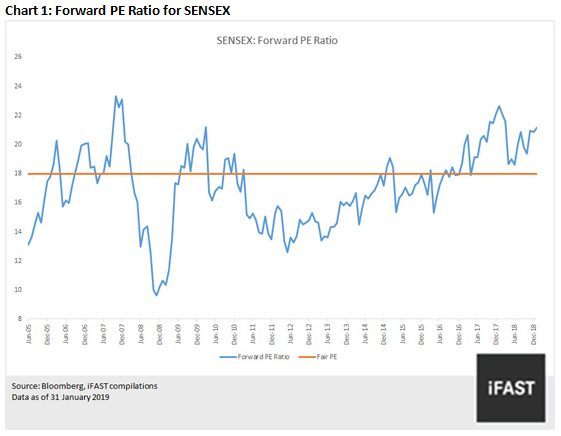

However, historically analysts have been overly optimistic on India’s earnings growth, with an average revision of -9% annually since 2012. Average estimated earnings growth since 2012 has only been about 6.7% annually, a far cry from the estimated 23.7% and 17.6% growth in the next two financial years.

We believe there is still a lot of room for downgrades in the future, thus pushing valuations further up if prices do not come down.

If we account for analysts' optimism and downgrade the earnings to be in line with the past, we get an annualised returns of 5.1% (inclusive of dividends) on the SENSEX Index for the next two years if we assume that prices will revert to the mean, which is our fair PE of 18.0X. If we assume that the consensus estimates are right, we have an annualised return of 8.3% over two years. Comparing this against the yields of its local 10-year corporate AAA bonds and sovereign 10-year bonds (8.7% and 7.4% in local currency as of 4 February 2019), the returns are not very attractive, particularly for an emerging market which is typically riskier for investors.

Although we might miss out on some potential gains due to India’s fantastic growth story, the opportunity cost of leaving/investing your funds in India is quite high as there are other markets that are looking more attractive than India. On the upside, if the US Fed pauses or cuts rates, the RBI could follow suit (which they already have), thus boosting earnings growth prospects. However, markets seem to be over-jubilant over this situation, with the scenario of the Fed continuing to raise interest rates due to good US economic data being forgotten now.

Sectoral growth

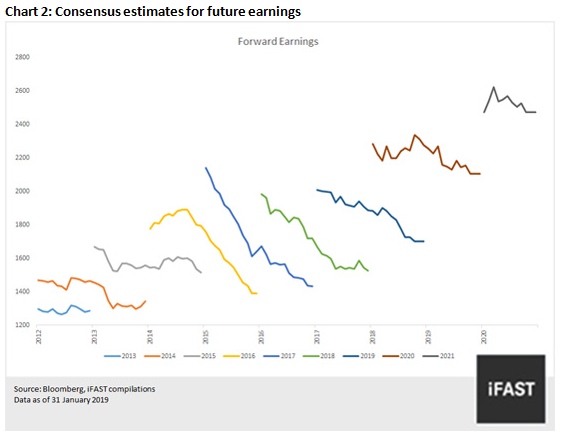

Moving down to the sector-level, most of the sectors are estimated to grow at fairly high levels for 2019, save the consumer discretionary sector, which is heavily affected by Tata Motors heavy losses. For healthcare and industrials, they are basically single stocks of Sun Pharmaceutical and Larsen & Toubro respectively. For Sun Pharmaceutical, its price has been hit badly due to a financial scandal.

For the energy sector, Reliance Industries makes up the majority of it and represents 10.75% of the whole SENSEX index. Its high estimated earnings growth for FY19 and FY20 of 14.7% and 20.5% is also a big factor for the aggregate estimated earnings growth.

High growth stocks?

We now zoom in to a few stocks that are overvalued and have questionably high growth prospects – State Bank of India, Axis Bank, and Hindustan Unilever with them consisting 2.95%, 3.14% and 3.36% of the SENSEX Index respectively.

For the two banks, they suffered a huge hit earnings-wise due to increased loan provisions in 2017. As they are expected to recover from the earnings hit, they are projected to have earnings growth of 370% and 220% from FY17 to FY20 respectively. If the earnings growths are realised, the stocks will then have better valuations with FY20 forward PE ratios of 9.2X and 17.9X, compared to FY17 forward PE ratios of 34.2X and 40.2X respectively. However, as prices did not reflect the drop in earnings, we are wary of their valuations and their earnings growth prospects.

For Hindustan Unilever, its current valuations are very high for a consumer staples stock. It currently boasts a trailing-twelve-month PE ratio of 72.0X, FY19 PER of 60.4X, FY20 PER of 50.8X, PB ratio of 54.9X and Price-Sales ratio of 10.8X. Furthermore, its earnings is forecasted to grow 19% annually from 2019 to 2021.

Based on how income has grown only 2% annually in real terms for 90% of income-earners in India from 1951 - 2014, analysts might be a tad too optimistic on forecasted earnings growth for Hindustan Unilever. Earnings growth that are way lower than current projections will drive valuations higher even further.

So, what should I do?

Considering all of the above reasons, we believe there are better investment opportunities if we examine the current environment from a risk-reward perspective. Some opportunities are listed as per this article and also, Japan. We are thus downgrading India to 3.0 Stars – Attractive.

If you currently have a large exposure to India, consider gradually reducing your allocation and rebalancing to other markets. If you desire to continue investing into India or increasing exposure, consider doing it through Regular Savings Plan (RSP) and with a small allocation.

We are wary about investing in India through ETFs as it is likely that there exists asymmetric information in the market that a fund manager can exploit.

We recognise that India remains a good investment prospect for the long-run but current prices may not be a good time to enter the market.

In our next article, we turn our attention to the macro side of things.

The Research Team is part of iFAST Financial Pte Ltd.

Disclaimer

iFAST and/or its content and research team's licensed representatives may own or have positions in the mutual funds of any of the Asset Management Company mentioned or referred to in the article, and may from time to time add or dispose of, or be materially interested in any such. This article is not to be construed as an offer or solicitation for the subscription, purchase or sale of any mutual fund. No investment decision should be taken without first viewing a mutual fund's scheme information document including statement of additional information. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Investors should seek for professional investment, tax, and legal advice before making an investment or any other decision. Past performance and any forecast is not necessarily indicative of the future or likely performance of the mutual fund. The value of mutual funds and the income from them may fall as well as rise. Opinions expressed herein are subject to change without notice. Please read our disclaimer on the website.