Fund Selection Strategy

Your goals are as unique as you are. That's why at Top3Choice.com, we believe that your investment strategy needs to reflect the following:

- What is your goal?

- What is your path?

- What is your time frame?

- What is the risk you are comfortable with?

-

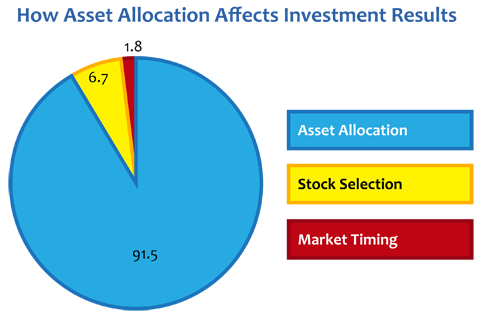

Asset Allocation

Asset allocation is a strategy that aims to balance risk and reward by distributing investments across asset classes according to your financial goals, capacity for risk, and time frame for investment. Allocation of investments accross asset classes is the single most important determinant of your investment results.

-

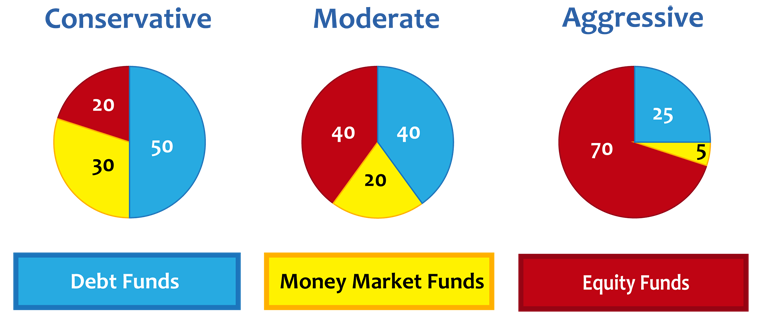

Determining the Right Asset Mix for You

Within each asset class, choosing the right investment mix is equally important. To this end, we design the right mix of mutual funds on the basis of your risk tolerance, time frame and expenses. Your time frame, current financial situation, and risk tolerance for market fluctuations will influence how aggressively or conservatively you choose to invest.

-

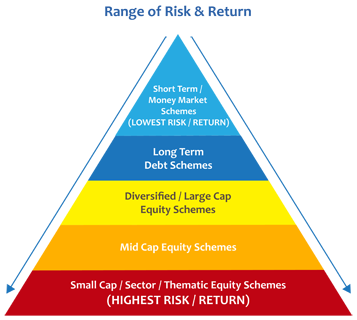

Importance of Portfolio Diversification

Diversification is nothing but spreading money across different asset classes to reduce risk. Picking the right mix of asset classes helps in limiting losses, and reducing fluctuation of investment returns without sacrificing much potential gain. At Top3Choice.com, we help identify a mix of mutual fund schemes that has the highest probability of meeting your financial goals at the level of risk you are comfortable with. Our proprietary decision engine helps you in allocating effectively.